AI-Led FinTech Observability and DevSecOps Platform

Protect revenue, prevent downtime, and maintain trust with proactive, intelligence-driven observability built for high-scale financial systems.

FinTech Observability is a Complex Eco System

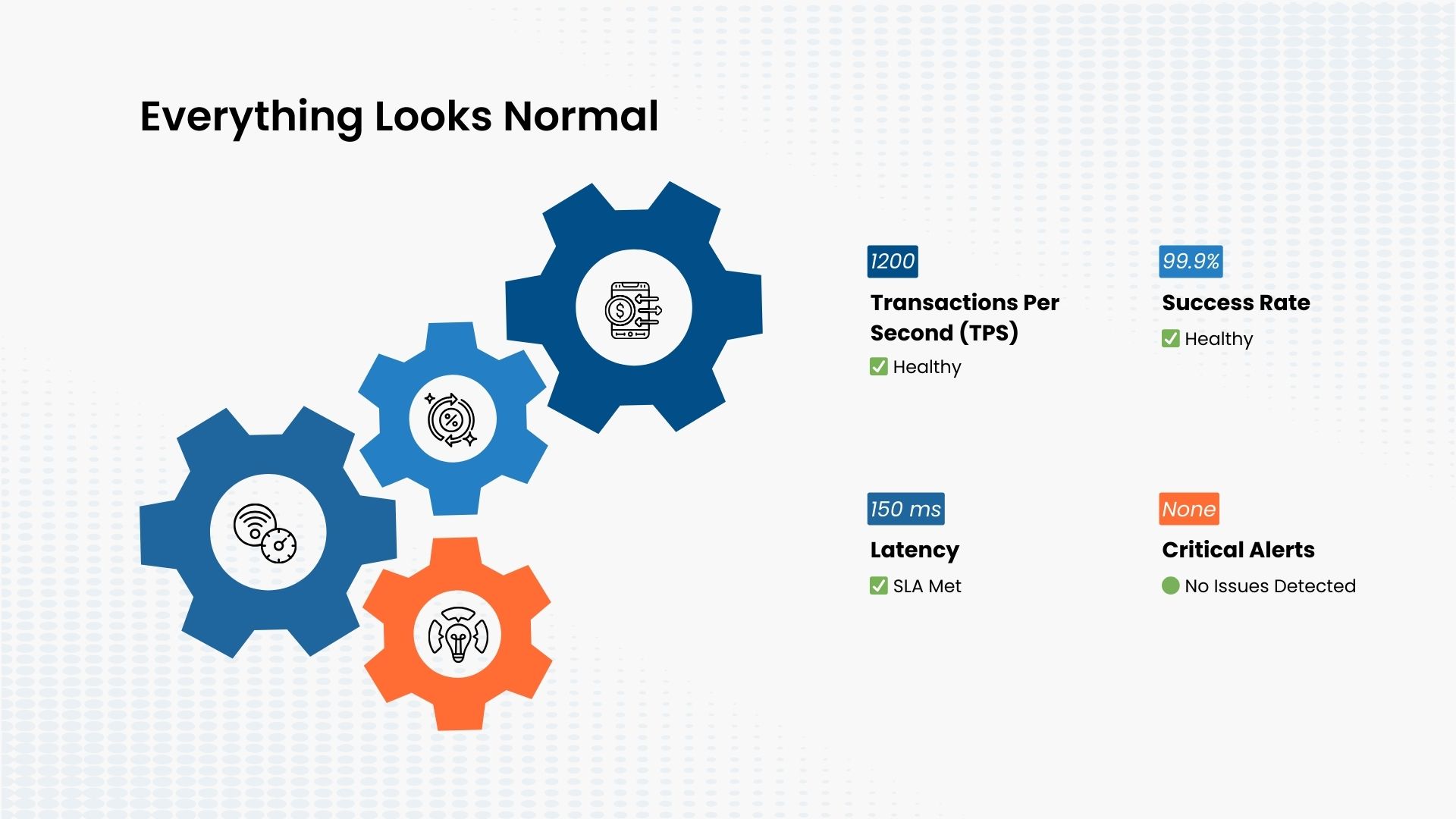

Too many dashboards don’t create visibility — they fragment it.

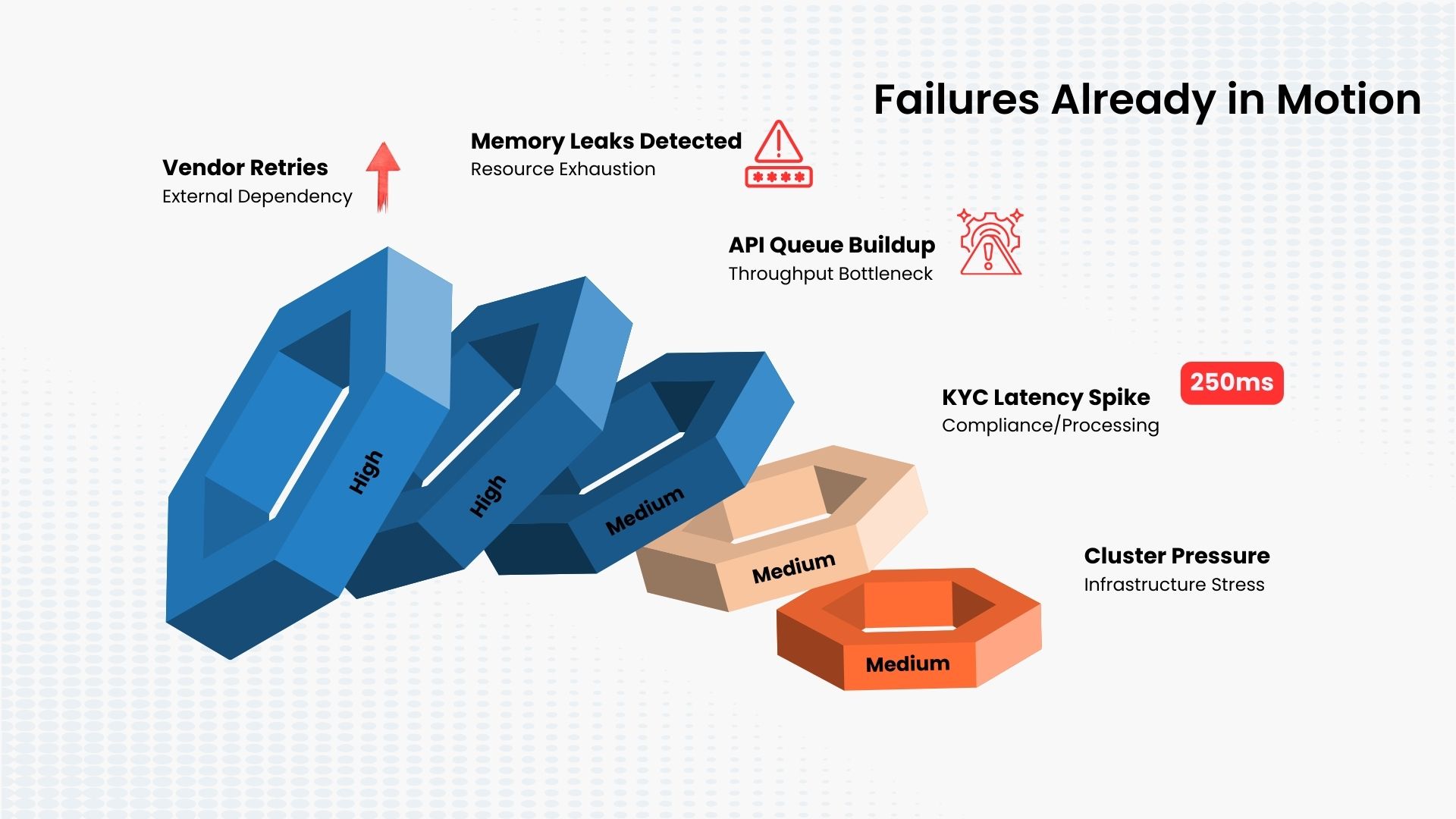

Real failures begin in the shadows — a slow payment hop, a failing KYC vendor, a degrading cluster, a memory spike, an overwhelmed API. By the time it reaches your dashboard, the customer has already felt it.

- Transactions Failed

- Spike in Support Calls

- Revenue Fall

- Customer churn

- Direct revenue loss

- Negative PR exposure

The Moment You Fix Visibility, Everything Changes

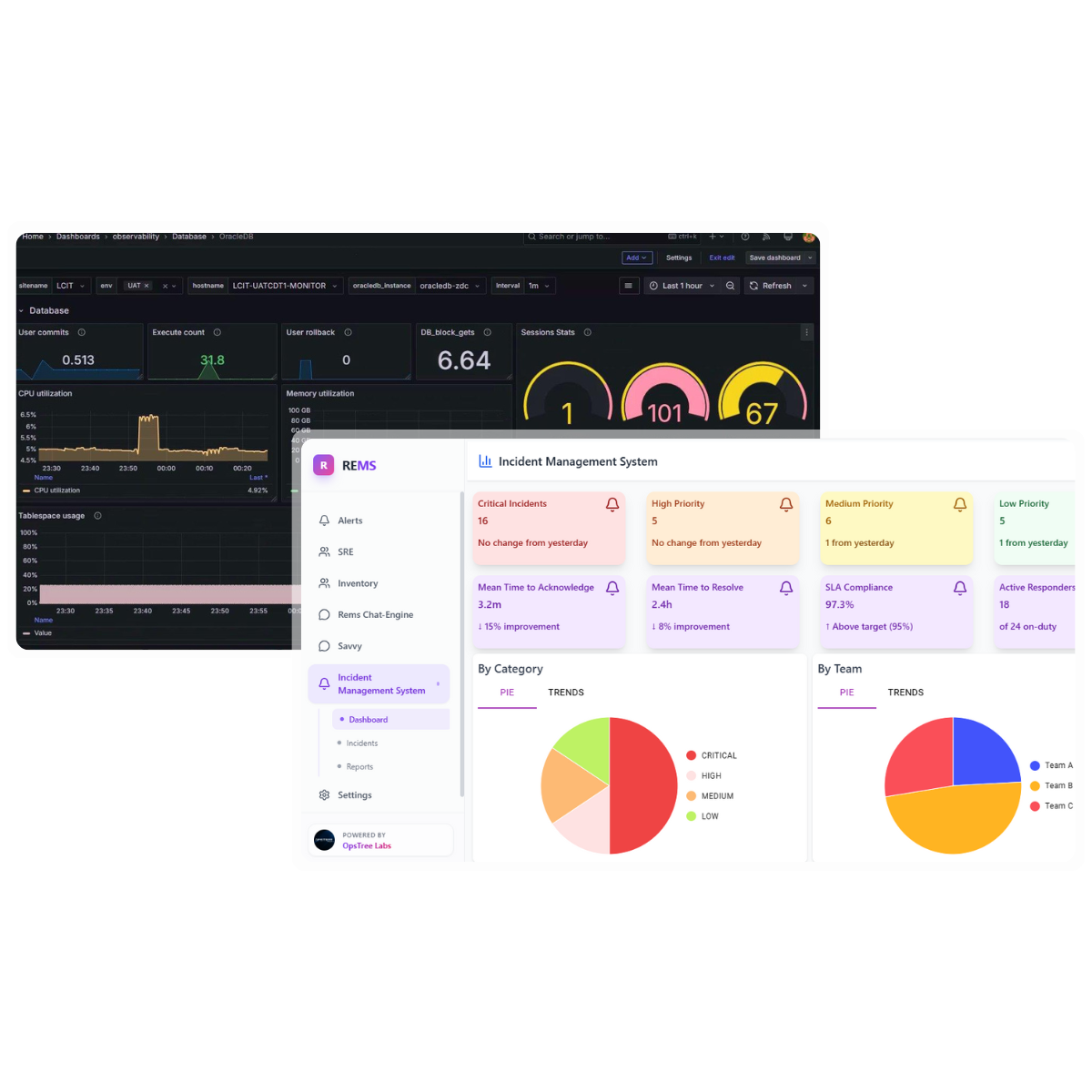

OpsTree Unified Observability Engine brings together OLLY’s unified visibility, REMS’ intelligent remediation, and BuildPiper MCP’s automation into a single, self-healing reliability system.

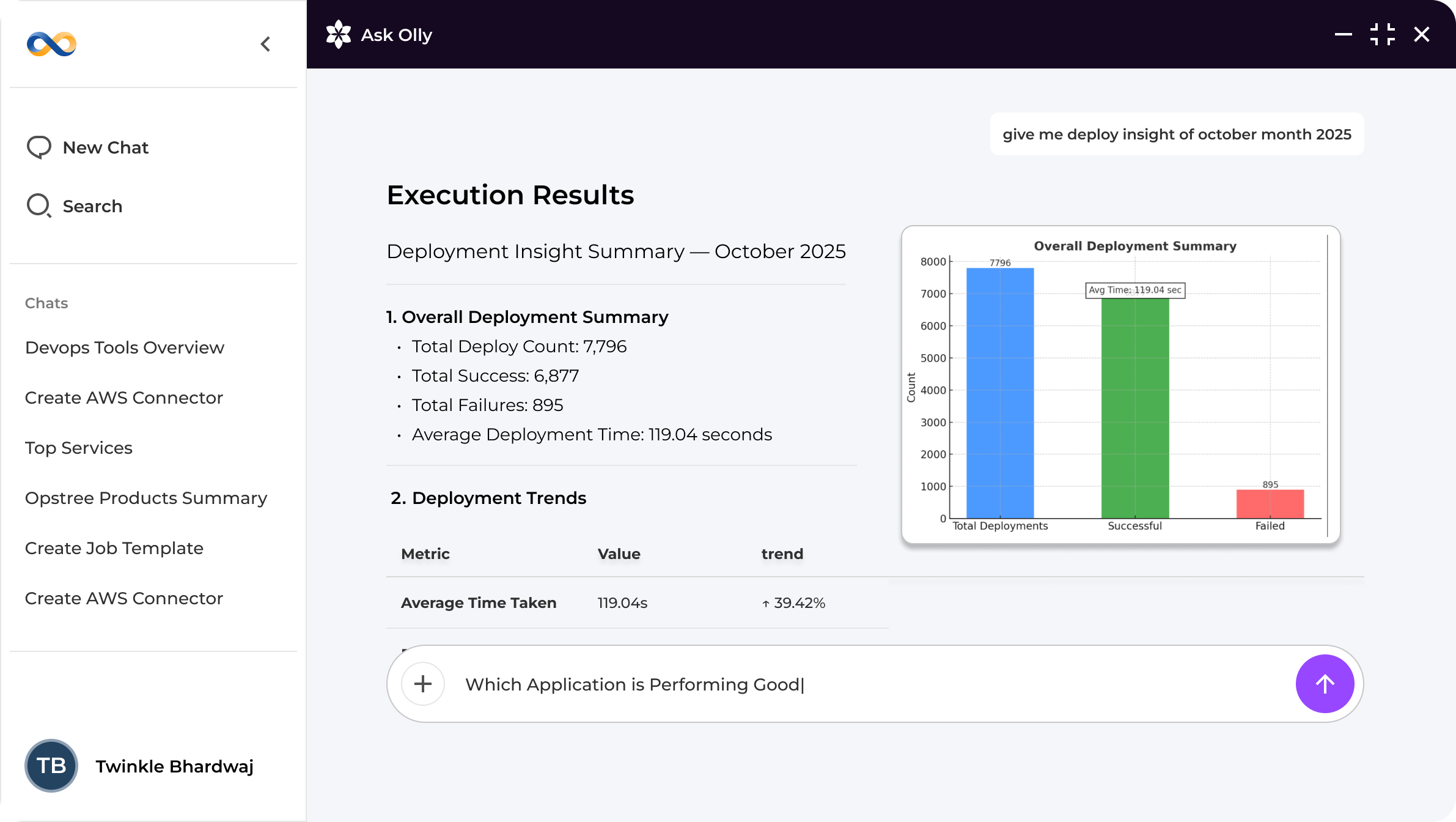

The Engine: OLLY (Unified Observability)

The eyes that capture every signal across your FinTech ecosystem.

OLLY delivers unified observability by correlating real-time telemetry across payment flows, APIs, cloud infrastructure, third-party vendors, and security events — giving teams instant clarity during incidents, reliable baselines, and trusted signals for automated response.

Transaction Visibility

Correlates logs, metrics, traces, events, and audit trails across applications, infrastructure, APIs, databases, and third-party services into a single, end-to-end system view.

Payment Failure Detection

Surfaces early degradation signals — such as payment latency spikes, KYC vendor slowdowns, API throttling, or cluster saturation — before issues cascade to customers or partners.

Reliability SLIs

Continuously tracks service-level signals aligned to business outcomes — transaction success rates, checkout latency, uptime during peak traffic, and customer experience SLAs.

Signals for Recovery

Feeds trusted, real-time telemetry into automation and remediation workflows to reduce MTTR, limit blast radius, and prevent repeat failures.

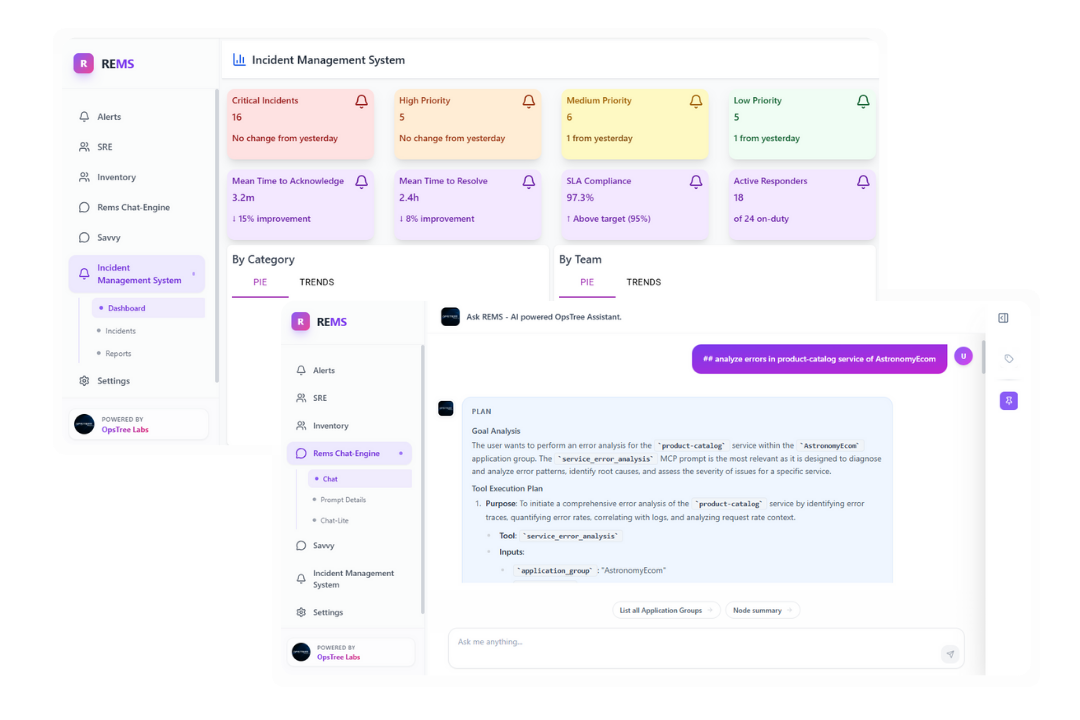

The Intelligence: REMS (Remediation & Migration System)

The brain that fixes, restores, and evolves FinTech systems.

REMS applies intelligent remediation and migration logic on top of OLLY’s unified signals — converting observability into guided, auditable actions that accelerate recovery, reduce operational risk, and safely modernize systems before issues impact customers or compliance.

Risk-Aware Remediation

Identifies early degradation patterns across payments, APIs, databases, and infrastructure, and recommends corrective actions to restore services before revenue or trust is affected.

Contextual Incident Response

Provides structured, AI-assisted incident workflows with real-time context, timelines, dependency mapping, and root-cause insights — eliminating guesswork during critical outages.

Safe FinTech Migrations

Uses live system signals to plan, validate, and execute safe migrations — from legacy infrastructure to Kubernetes, cloud-native platforms, or modern data pipelines — without disrupting live transactions.

Operational Risk Intelligence

Captures remediation knowledge, enables AI-powered search across incidents, services, and topology, and accelerates future resolution across FinTech operations teams.

When Things Break — Automation Takes Over

No war rooms. No panic. Just recovery.

When failures occur, manual coordination slows recovery and increases risk. Instead of pulling teams into war rooms, our automation layer — powered by BuildPiper MCP — activates instantly, executing proven, SRE-engineered remediation workflows without human delay.

Compliance-Ready Runbooks

Predefined, validated recovery actions triggered by real system and business signals, not static alerts.

Instant Payment Stabilization

Automatically restore stability by rolling back releases, restarting impacted components, or rerouting traffic during payment or API disruptions.

Self-Healing Transactions

Reduce blast radius and downtime through automated correction, ensuring customer experience remains intact even during failures.

SRE-Grade Reliability

Built and tuned for peak traffic, regulatory scrutiny, and zero-tolerance downtime — where reliability is a business requirement, not an ops metric.

Every action is designed, tested, and continuously refined by OpsTree SRE engineers with deep experience in high-scale, regulated FinTech environments.

Now, When Everything Fall in Place

Uptime Achieved

Fewer Failed Transactions

MTTR Improved

Deployment Velocity

Understand Your Operational Risk—Before It Impacts Revenue

We evaluate your infrastructure, delivery pipelines, and reliability posture to surface hidden risks, resilience gaps, and optimization opportunities—backed by actionable remediation guidance.

Securing the Path From Code to Customer Experience

In FinTech, reliability isn’t just about fixing what breaks — it’s about preventing issues long before customers ever feel them.

Trust & Compliance, Embedded Into Every Release

FinTech requires absolute confidence in every deployment — ensuring each change meets regulatory, security, and governance standards before it ever touches production.

- Policy-as-code pipelines, RBAC governance & secret management

- Continuous vulnerability scanning across CI & CD

- Cloud and infrastructure hardening aligned with RBI, PCI-DSS, SOC2

Safer, Faster Releases Without Deployment Anxiety

We help FinTech teams ship with confidence — using structured, automated delivery practices that reduce failures, increase predictability, and support rapid iteration.

- Standardized CI/CD pipelines & Terraform/IaC-driven environments

- Progressive rollouts with intelligent rollback strategies

- Automated deployment workflows engineered by OpsTree

Developer Velocity and Engineering Predictability

Your engineering teams move faster when the platform is stable, environments are consistent, and insights are transparent — enabling fewer interruptions and smoother delivery cycles.

- Self-service environment provisioning & standardized blueprints

- DORA metrics, release intelligence & engineering dashboards

- Automated troubleshooting & SRE-guided operational workflows

Leading Brands Trust Us

Real-world Impact with our Observability & DevSecOps Solutions

Our Partners

Your App is Up. Is Your KYC Vendor

3rd party failures like slow KYC hops and degrading payment gateways happen in the shadows. Don’t let external vendors silently kill your customer experience.

Of failed transactions happen at third-party touchpoints.

Cloud Reliability & Risk Insights for FinTech Platforms

Frequently Asked Questions About FinTech Observability & Reliability

What is FinTech observability and why is it critical for financial systems?

FinTech observability is the ability to gain real-time visibility into payment flows, APIs, cloud infrastructure, and third-party dependencies. It is critical because even minor failures can result in transaction loss, compliance risk, revenue impact, and customer trust erosion.

How is FinTech observability different from traditional monitoring?

Traditional monitoring focuses on isolated metrics and alerts. FinTech observability correlates telemetry across transactions, vendors, infrastructure, and security events—allowing teams to detect hidden failures and act before customers are impacted.

How does observability help prevent revenue loss in FinTech platforms?

By detecting early degradation in payment flows, APIs, and dependencies, observability helps prevent transaction failures, reduces MTTR, and minimizes downtime—directly protecting revenue and customer experience.

Is FinTech observability important for regulatory compliance?

Yes. FinTech observability provides audit-ready telemetry, traceability, and incident visibility that support compliance with standards such as PCI-DSS, SOC 2, and RBI guidelines.

How does AI-led observability improve FinTech reliability?

AI-led observability analyzes patterns across telemetry to identify risks, predict failures, and support automated remediation—enabling proactive reliability instead of reactive incident response.

What is a FinTech reliability audit?

A FinTech reliability audit evaluates observability gaps, incident response readiness, automation maturity, and operational risk exposure across infrastructure, pipelines, and production systems.

Can observability reduce MTTR in payment systems?

Yes. Correlated observability combined with automated remediation significantly reduces MTTR by enabling faster root cause identification and guided recovery actions.

Is OpsTree a platform, a service, or both?

OpsTree provides an AI-led FinTech observability and reliability platform, supported by expert-led services. The platform delivers unified visibility, intelligent remediation, and automation, while OpsTree engineers help design, implement, and optimize reliability across regulated financial systems.

Get in Touch

Secure reliability for your FinTech platform

Whether you’re dealing with payment failures, rising MTTR, compliance pressure, or scaling challenges, our experts will review your environment and recommend next steps to improve stability, resilience, and customer experience.