Do you remember the viral Twitter storm that hit a leading investment platform recently?

A user claimed they invested in a Mutual Fund. Their bank account was debited. The app dashboard showed a green tick and even generated a Folio Number. To the user (and the app’s frontend), the transaction was a success.

But days later, when they tried to redeem, the fund house said the money never arrived.

The user took to X (formerly Twitter), alleging “fraud.” The post went viral, racking up millions of views and triggering panic. The platform’s reputation took a massive hit overnight, not because their servers crashed, but because their data consistency failed silently.

This is the perfect anatomy of a Shadow Failure. The infrastructure was up. The app was responsive. But the business logic was broken.

What is a Shadow Failure?

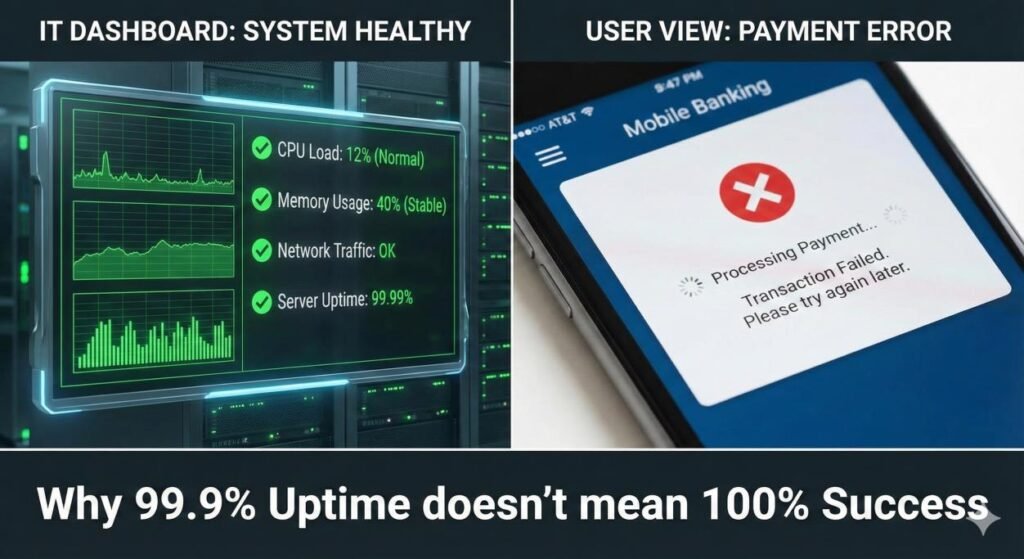

A Shadow Failure occurs when your technical metrics (infrastructure) decouple from your business metrics (outcomes).

In a Wealthtech, Lending, or Insurtech environment, your microservices might be responding with a 200 OK status, effectively telling your monitoring tools “I am fine.” But inside that response, the business logic is broken, perhaps a third-party KYC provider timed out, or a payment gateway returned a soft decline.

To a standard monitoring tool, the system looks healthy. To the user trying to withdraw funds or buy insurance, the system is dead.

The High Cost of “Green Dashboards”

In Fintech, trust is the only currency that matters. A Shadow Failure doesn’t just annoy users; it creates financial liability.

- The Wealthtech “Slippage” Scenario: A user tries to buy a stock at $100. Your internal order management system lags, not because the server is down, but because of an unoptimized database query locking the row. By the time the trade executes, the price is $102.

- Result: The user loses money. You face a potential regulatory complaint.

- The Lending “Drop-off” Scenario: A borrower uploads their documents. Your OCR service takes 3 seconds too long to verify the ID. The connection remains open (so no “error” is logged), but the user gets frustrated by the loading spinner and closes the app.

- Result: You paid for the customer acquisition (CAC), but lost the conversion due to a FinTech uptime and reliability issue that never triggered an alert.

The Solution: Stop Monitoring Servers, Start Monitoring Money

Traditional monitoring asks: “Is the container running?” FinTech monitoring and observability asks: “Did the loan disbursement land in the user’s account?”

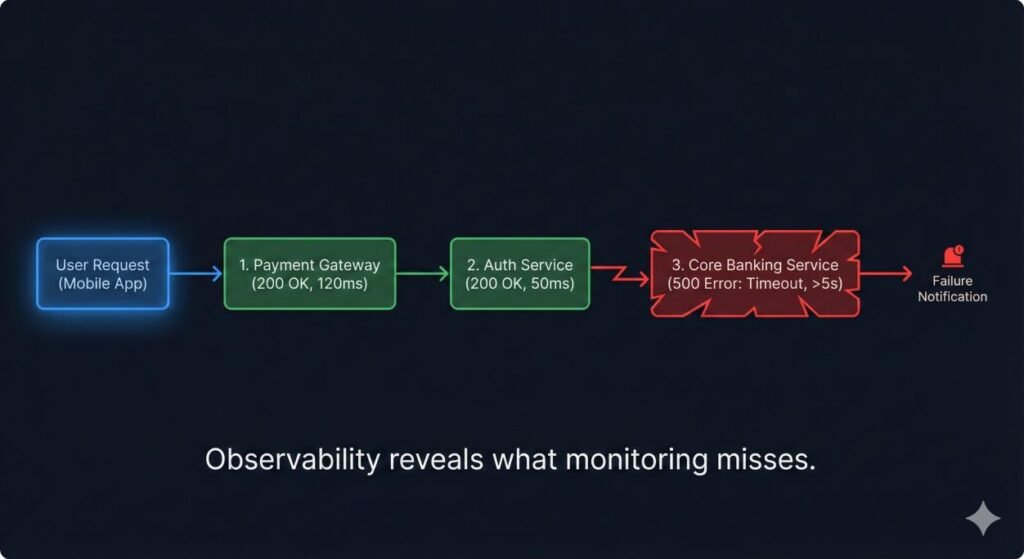

To catch Shadow Failures, you must evolve your observability strategy. This is where the shift from simple monitoring to true FinTech monitoring and observability happens.

- Trace the “Business Transaction,” Not Just the RequestYou needpayment system observability that correlates logs, metrics, and traces across the entire lifecycle of a transaction. If a payment fails, you shouldn’t just see “Error 500.” You should see that User X attempted a transaction, it passed the gateway, but failed at the Core Banking Settlement layer.

- Measure the “Golden Signals” of FintechForget generic CPU spikes. Your dashboard needs to scream if:

- Loan Approval Rate drops below 80% (even if servers are fine).

- KYC Success Rate dips by 5% in the last 10 minutes.

- Payment Gateway Latency exceeds 3 seconds (even if the gateway isn’t down).

The End of the War Room

When a Shadow Failure hits, the typical reaction is chaos. Teams scramble into a “War Room,” pointing fingers at the network, the code, or the vendor. Meanwhile, transactions are failing.

Effective FinTech incident management changes this dynamic. By correlating business outcomes with technical signals, you don’t just find out that something is wrong, you know exactly where the money is stuck.

The Verdict: Watch the Business, Not Just the Boxes

Your customers don’t care about your uptime SLA. They care about their money. If your app is up but their transaction is stuck, you aren’t a fintech company, you’re a liability.

It’s time to turn the lights on in the shadows.

Struggling to correlate your infrastructure metrics with revenue drops? See how we help fintechs build Unified Observability & Reliability to stop silent failures.

Related Searches : AWS Consulting Partner | DevOps Company | DevOps and DevSecOps Services