In e-commerce, a slow page load means a frustrated user. In high-stakes FinTech, a slow response means a lost asset.

We often talk about “uptime” as the holy grail. But for platforms managing Real-Time Credit Decisioning or Algorithmic Trading, uptime is just the baseline. The real battleground is latency.

There is a “Revenue Gap” that exists between a transaction taking 50ms and 200ms. In low-margin payments, this might be negligible. But in high-margin lending, that delay is the difference between capturing a prime borrower and losing them to a competitor.

Get a complimentary FinTech reliability audit to uncover micro-latency, SLI/SLO error-budget risks, and fix them fast with a unified observability platform.

The Hidden Cost of Micro-Latency

In traditional banking, customers expect to wait. In Embedded Finance and BNPL (Buy Now, Pay Later), they don’t.

Imagine a customer at a checkout screen, impulse-buying a high-value item. They select your “Pay Later” option.

- 0-1 Seconds: Instant trust. The transaction feels seamless.

- 3-4 Seconds: Doubt creeps in. “Did it freeze? Did I get charged?”

- 5+ Seconds: The host platform (the e-commerce site) often triggers a hard timeout to prevent a hung session.

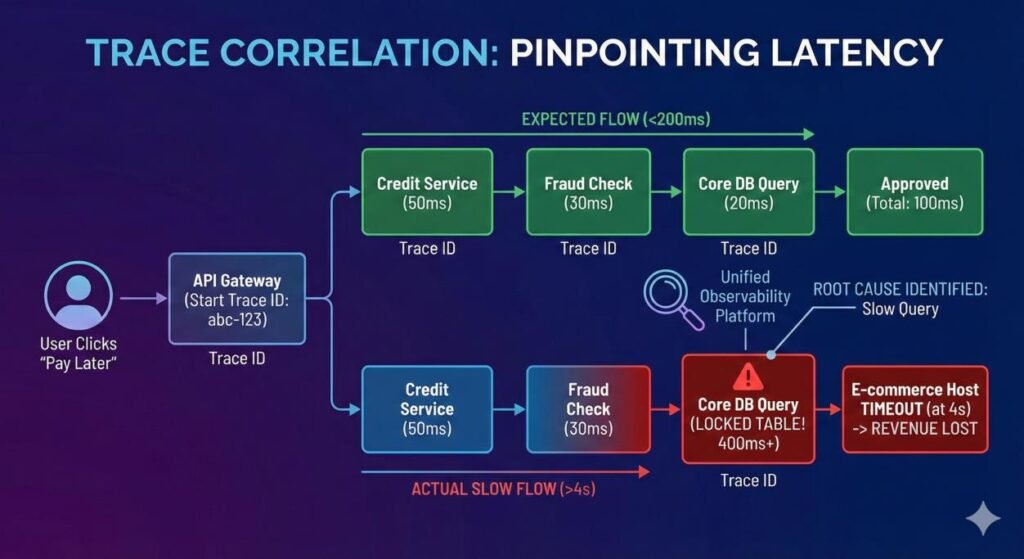

If your payment system observability isn’t tuned to catch these micro-latencies, you are flying blind. You might see that the API returned a “Success” (200 OK), but you missed the fact that it took 400ms too long to load. In that time, the e-commerce platform timed out, the user abandoned the cart, and you lost the interest revenue on that loan forever.

Defining the “Speed Budget” (SLIs & SLOs)

To close the gap, engineering teams must shift from tracking “server health” to tracking “financial health.”

This requires rigorous SLI SLO error budget monitoring. You need to define a Service Level Objective (SLO) that says: “99% of credit risk checks must complete within 200ms.”

- The SLI (Indicator): The actual time taken for the API to respond.

- The Error Budget: The revenue you are willing to risk before you declare an incident.

When you breach this budget, it’s not an IT issue; it’s a P&L issue.

Finding the Ghost in the Machine

The challenge with latency is that it moves. One minute it’s a slow third-party KYC provider; the next, it’s a locked table in your core ledger.

This is why a unified observability platform is non-negotiable. You cannot debug latency by looking at logs in one tool and metrics in another. You need logs metrics traces correlation to see the full journey of the request.

You need to be able to ask: “Show me every high-value loan application that timed out, and overlay the database performance at that exact second.”

Reliability is a Feature

The winners in the next phase of FinTech won’t just be the ones with the best rates or the slickest UI. They will be the ones with the fastest execution.

By investing in FinTech reliability engineering, you are doing more than just fixing bugs. You are ensuring that when a borrower hits “Apply,” the capital moves. Instantly.

Don’t let 50 milliseconds cost you your best customers.

Related Searches – DevSecOps Services | Data Engineering Company | Platform Security Management services | AI-powered DevSecOps Platform